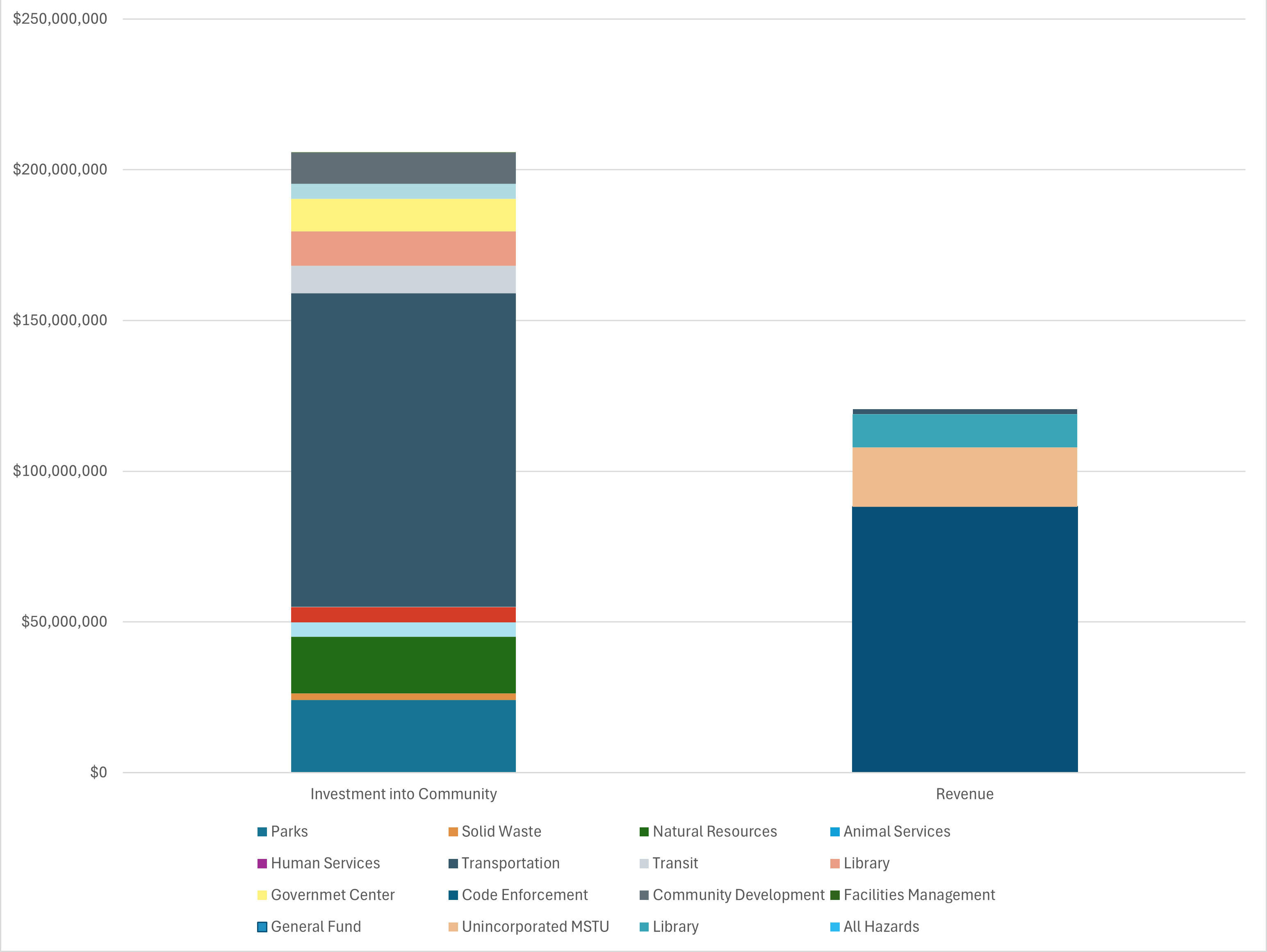

Specific CIP improvements and operating investments in Lehigh Acres = $210,144,296.75 over the past three years*

*Does not include Sheriff's Office, Courts and Constitutionals

Annual Property Tax revenue generated in Lehigh Acres:

- General Fund - 3.7623 mills = $29,403,554

- Unincorporated MSTU - 0.8398 mills = $6,563,300

- Library – 0.4714 mills = $3,684,139

- All Hazards – 0.0693 mills = $541,601

The following investments in Lehigh Acres reflects capital improvements (CIP) made within the last four (4) years and facilities/projects operating budgets from fiscal year 2021 to date: